April 5, 2025 - 22:26

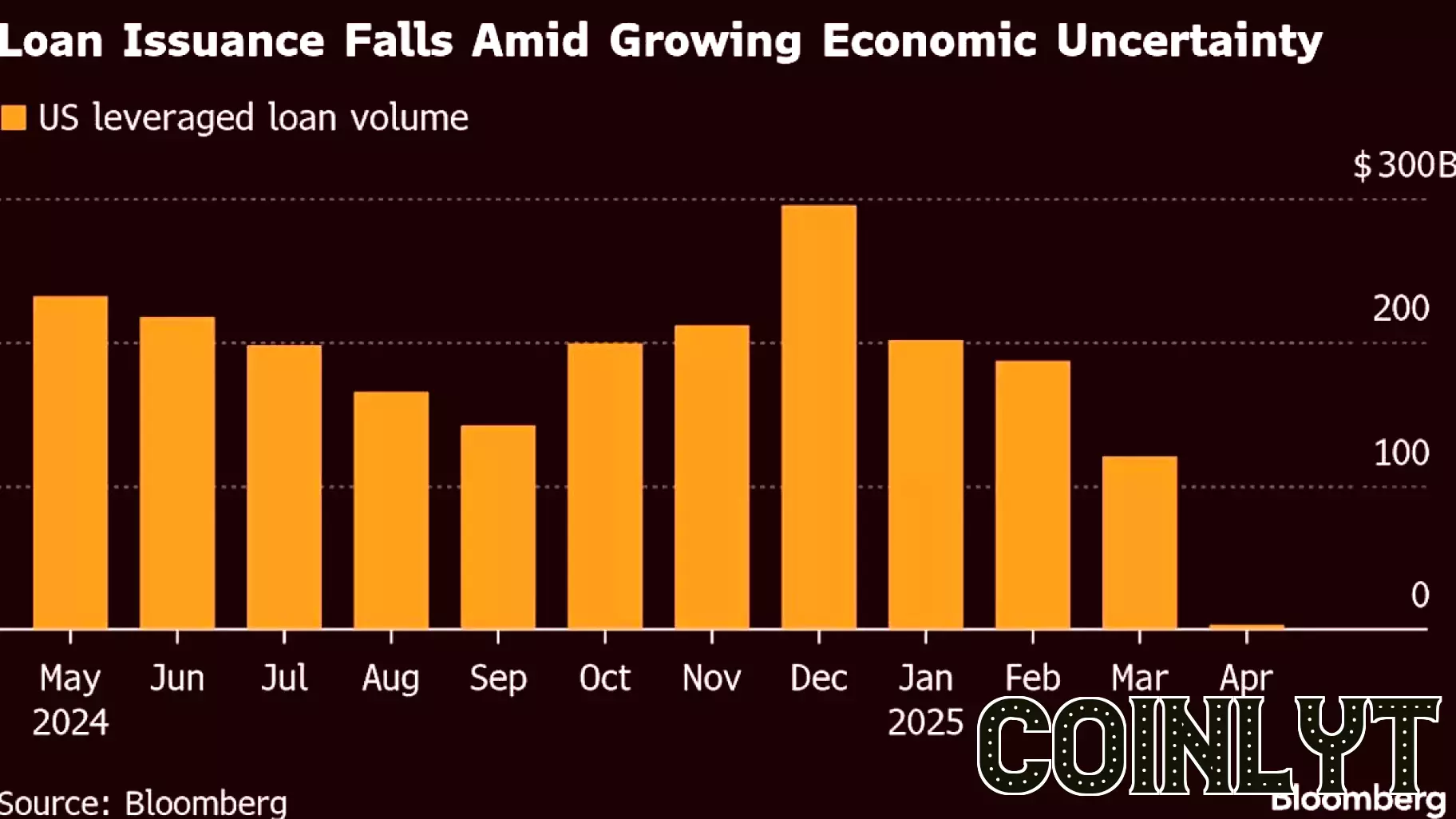

Recent developments in the leveraged finance sector have raised alarms as deal-making has come to a standstill, leading to significant disruptions in the financial markets. This stagnation has prompted fears that banks may find themselves burdened once again with hung debt from acquisitions they previously committed to.

As the economic landscape shifts, the repercussions of tariffs are becoming increasingly evident. The financial strain is particularly felt in regions like New York, where local officials are voicing concerns about the negative effects on the economy. The uncertainty surrounding these tariffs has contributed to a lack of confidence among investors, further exacerbating the challenges faced by banks and financial institutions.

With the market's current volatility, stakeholders are closely monitoring the situation, aware that a resurgence of hung debt could have detrimental effects on the broader financial ecosystem. The implications of these developments are likely to unfold in the coming months, as both banks and businesses navigate this precarious environment.